Ethereum Price Prediction: $4,000 in Sight as Technicals and Sentiment Align

#ETH

- Technical Breakout: Price trading above upper Bollinger Band with MACD showing reduced bearish momentum

- Institutional Demand: SharpLink Gaming's accumulation and derivatives activity supporting price floor

- Whale Divergence: Large transfers and short positions creating near-term volatility

ETH Price Prediction

ETH Technical Analysis: Bullish Breakout Potential

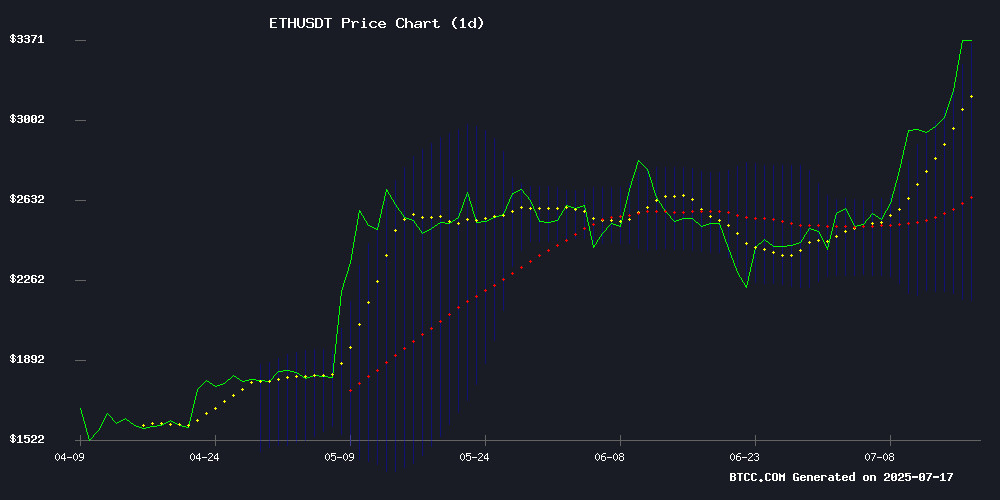

According to BTCC financial analyst Michael, Ethereum's current price of $3,458.31 sits significantly above its 20-day moving average ($2,765.76), indicating strong bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-114.79), suggesting weakening downward pressure. Notably, the price has breached the upper Bollinger Band ($3,380.34), which typically signals overbought conditions but can also precede extended rallies in strong uptrends.

Ethereum Market Sentiment: Institutional Accumulation vs. Whale Divergence

Michael notes conflicting signals from recent headlines: While SharpLink Gaming's massive ETH accumulation and institutional demand are driving bullish sentiment (evidenced by the $3,400 breakout), substantial whale activity shows profit-taking behavior. The $62 million short position and $374M in whale transfers create near-term resistance, though analyst predictions of $4,000 suggest overall confidence in Ethereum's fundamentals.

Factors Influencing ETH’s Price

SharpLink Gaming Becomes Largest Corporate Holder of Ethereum, Surpassing Ethereum Foundation

SharpLink Gaming has aggressively expanded its ethereum holdings, purchasing an additional 20,279 ETH worth $68.38 million on Thursday. This follows a series of acquisitions totaling 111,609 ETH over eight days, valued at $343.38 million. The Minneapolis-based firm now holds more ETH than the Ethereum Foundation itself.

The company's buying spree began just over a month ago, with 99.7% of its holdings allocated to staking protocols. Thursday's purchases included two separate transactions: 9,425 ETH ($31.88 million) followed by 10,854 ETH ($36.5 million) three hours later. This institutional accumulation signals growing corporate confidence in Ethereum as a long-term strategic asset.

SharpLink's position as the largest corporate ETH holder was cemented earlier this week when it disclosed holdings of 74,656 ETH acquired between July 7-13. The scale and speed of these acquisitions mark a significant shift in institutional adoption of cryptocurrency, particularly among non-traditional financial firms.

Ethereum Breaks $3,400 as Investors Split Between Accumulation and Profit-Taking

Ethereum surged past $3,400, sparking divergent strategies among investors. While some capitalized on the milestone to take profits, others aggressively accumulated ETH, underscoring the market's polarized sentiment.

SharpLink Gaming and World Liberty Financial emerged as key players, significantly boosting their Ethereum holdings. SharpLink alone added 20,279 ETH worth $68.38 million, bringing its total stash to 321,000 ETH with an average purchase price of $2,745. The firm now sits on an unrealized profit of $204 million.

The altcoin's rise to become the 30th largest global asset—overtaking Johnson & Johnson—has fueled Optimism among analysts. ETH's price appreciation of 6.87% in 24 hours, peaking at $3,424 before settling at $3,324, reflects growing institutional confidence.

ZARO Launches as a Decentralized Meme Coin with Locked Liquidity and Community Focus

ZARO has emerged as a decentralized experiment, aiming for cultural permanence in a speculative market. Launched as a meme coin with no presale, team tokens, or roadmap, ZARO renounced ownership and locked liquidity for 255 years. The token is designed as a permanent cultural artifact on Ethereum, with a fixed supply of 1 billion and 0% tax.

The project emphasizes community-driven growth, with no central authority or team control. The contract is Immutable and audited by Thirdweb and OpenZeppelin frameworks. ZARO trades on Uniswap, with liquidity locked until 2280, and the entire supply was donated to the public pool.

ZARO is more than a token; it’s a meme mascot designed to reflect and unite global culture. Through the ZaroVerse ecosystem, the project is expanding into multilingual and multicultural spaces, offering no utility or entitlements but simply existing as a blockchain-based artifact.

Ethereum Price Breaks Out: Smashes $3,400 Mark in Bullish Run

Ethereum surged past the $3,400 threshold, marking a significant bullish momentum. The cryptocurrency broke through key resistance levels, starting with a decisive move above $3,150, followed by a steady climb to $3,250. At its peak, ETH tested $3,423 before entering a consolidation phase.

The current trading pattern shows Ethereum holding above the 100-hourly Simple Moving Average, with a bullish trend line forming at $3,300 on the hourly chart. Market observers note that maintaining support above $3,220 could pave the way for further gains, while resistance NEAR $3,420 remains a critical level to watch.

Ethereum's outperformance against Bitcoin highlights its growing strength in the market. Traders are eyeing the $3,500 zone as the next potential target if the upward trajectory continues.

Ethereum Could Surge Past $4,000 This Week, Analyst Predicts

Ethereum is showing strong bullish signals, with prominent crypto analyst Kaleo (@CryptoKaleo) forecasting a dramatic upward move that could push ETH above $4,000 in the coming days. In a post on X, Kaleo described the potential for a "God candle"—a massive green candlestick—that would catapult the asset beyond its current resistance levels. "God candle to $4K+ this week… honestly though I wouldn’t be surprised if we see something like this play out after today’s news," he wrote.

The ETH/USDT pair has been trading within an ascending wedge pattern for over three months, with resistance near $3,000. A mid-June breakdown briefly sent prices to $2,100, but a swift recovery—dubbed "Reclaim" by Kaleo—reestablished the wedge's support. The recent breakout above $3,030 has reignited bullish sentiment, with technical projections suggesting a rapid ascent toward $4,000.

Crypto Whale Bets $62 Million Against Ethereum Amid Market Pressure

A prominent cryptocurrency trader has taken a massive $62.42 million short position against Ethereum, leveraging 18x to capitalize on ETH's struggle to reclaim the $3,500 resistance level. The whale, identified by wallet address "0x2258," entered the trade at $3,060 and is already sitting on $1.14 million in unrealized profits as ETH hovers below $3,000.

The position faces liquidation at $3,505—a level that served as January 2025's peak. Market watchers note the whale's track record: over $15 million in prior profits, including successful counter-trades against institutional players. Such high-leverage bearish bets signal deepening skepticism about Ethereum's near-term prospects.

Ethereum Surges Past $3,400 Amid Institutional Accumulation and Derivatives Demand

Ethereum rallied above $3,400 on Wednesday, buoyed by aggressive treasury accumulation from public companies and robust derivatives activity. The second-largest cryptocurrency now trades at $3,350, with weekly gains exceeding 25%.

Nasdaq-listed firms including SharpLink Gaming and Bit Digital have collectively acquired 570,000 ETH over two months, signaling growing institutional conviction. Derivatives markets echo this sentiment, with open interest swelling by 1.84 million ETH in July while maintaining healthy funding rates.

The staking ecosystem continues expanding, with pools absorbing an additional 1.51 million ETH since June. Technical analysts note the $3,470 resistance level as the next hurdle before potential ascent toward $3,600.

Ethereum Whales Move $374M in ETH Amid Market Rally

Ethereum leads the crypto market surge with a 6.58% gain, trading near $3,248 as whale activity spikes. Over $374 million in ETH moved across exchanges in four hours, including a $127 million transfer to Kraken. Institutional interest appears strong, though large transaction volume dipped 5.87%.

Analysts speculate whether the transfers signal impending sell pressure or strategic positioning. Despite the volatility, Ethereum's holder count reaches record highs, sustaining cautious optimism. The market watches whether whale movements will fuel or fracture the current rally.

Uniswap Surpasses 1.2 Billion Swaps Amid Surging Usage and Leadership Transition

Uniswap, the leading decentralized exchange protocol, has processed over 1.2 billion swaps between 2024 and the first seven months of 2025, underscoring its dominance in decentralized finance. The platform averaged more than 90 million monthly swaps during this period, with 2024 alone recording 670 million transactions—a threefold increase from the previous year.

Trading volume reached $73 billion in the past 30 days, reflecting robust on-chain activity. The protocol's growth trajectory remains steep, with 2025 already exceeding 640 million swaps by mid-year. This surge coincides with the resignation of COO Mary-Catherine Lader, following the SEC's decision to close its case without enforcement action.

How High Will ETH Price Go?

Michael projects two potential scenarios for Ethereum:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish | $4,200-$4,500 | Sustained close above $3,500 with declining MACD histogram |

| Consolidation | $3,200-$3,600 | Whale selling pressure counters institutional demand |

Key resistance lies at $3,680 (1.618 Fibonacci extension), while support holds at $3,150 (20-day MA convergence).

$4,200-$4,500

$3,200-$3,600

$3,680

$3,150